Tesla Resale Shocker For Owners: A Comprehensive Guide To Understanding The Impact

Tesla resale values have become a hot topic among electric vehicle (EV) enthusiasts, investors, and potential buyers alike. As Tesla continues to dominate the EV market, understanding the factors that influence resale value is crucial for current and future Tesla owners. Whether you're planning to sell your Tesla or considering purchasing one, this article dives deep into the resale shocker affecting Tesla owners.

The electric vehicle revolution has transformed the automotive industry, and Tesla remains at the forefront of this movement. However, with the growing popularity of Tesla vehicles comes the challenge of maintaining strong resale values. Many Tesla owners have encountered unexpected surprises when attempting to sell their vehicles, prompting a closer look at the factors influencing these outcomes.

This article aims to provide valuable insights into Tesla resale trends, market dynamics, and the implications for Tesla owners. By exploring key aspects such as depreciation rates, market demand, and industry trends, we aim to equip you with the knowledge needed to navigate the complexities of Tesla's resale market.

- Scarlett Johansson No More Black Widow

- Trump Admin Shreds Usaid Evidence A Comprehensive Analysis

- Walmart Compensates Customer Over Car Loss A Comprehensive Analysis

- Bannon Hints At Trumps Putin Support A Comprehensive Analysis

- Trump Evades Air Force Interview Question A Comprehensive Analysis

Understanding Tesla Resale Value

Why Resale Value Matters for Tesla Owners

For Tesla owners, resale value plays a critical role in their overall financial decision-making. Whether you're upgrading to a newer model or simply selling your vehicle, understanding the resale dynamics can significantly impact your return on investment. Tesla resale values have historically been strong due to the brand's reputation and innovation, but recent trends suggest a shift in market sentiment.

Data from industry reports indicate that Tesla vehicles retain their value better than most traditional internal combustion engine (ICE) vehicles. However, the rapid introduction of new models and technological advancements has led to increased competition and downward pressure on resale prices. Understanding these dynamics is essential for Tesla owners looking to maximize their returns.

Key factors influencing Tesla resale value include:

- Democrat Taunts Gop Over Shutdown A Comprehensive Analysis

- Fired Nih Workers Face Job Hurdles A Comprehensive Guide To Understanding Their Challenges And Opportunities

- Kaitlan Collins Clashes Over Ceo Assassin Website A Deep Dive Into The Controversy

- Trumps Doj Fights Mass Firings A Deep Dive Into The Legal And Political Battle

- Haley Biebers Marriage Causes Family Rift An Indepth Exploration

- Model year and mileage

- Market demand for specific models

- Technological advancements in newer models

- Economic conditions and consumer preferences

Depreciation Rates of Tesla Vehicles

Depreciation is a significant factor affecting Tesla resale values. Unlike traditional vehicles, Tesla's depreciation rates are influenced by unique factors such as battery degradation, software updates, and the introduction of new models. According to a report by Edmunds, Tesla vehicles typically retain around 56% of their value after three years, outperforming most ICE vehicles but trailing behind some luxury brands.

The depreciation rates vary across different Tesla models. For instance, the Model S and Model X tend to hold their value better compared to the more affordable Model 3 and Model Y. This disparity is attributed to factors such as production volumes, target market, and perceived exclusivity. Understanding these variations is crucial for Tesla owners planning to sell their vehicles.

Market Demand and Supply Dynamics

The Role of Market Demand in Tesla Resale

Market demand plays a pivotal role in determining Tesla resale values. As Tesla continues to expand its production capacity and introduce new models, the supply of used Teslas in the market has increased significantly. This increase in supply, combined with fluctuating consumer preferences, has created a challenging environment for Tesla owners looking to sell their vehicles.

Geographic location also influences market demand. In regions with strong EV adoption rates, such as California and Norway, Tesla resale values tend to remain stable. Conversely, in markets with limited EV infrastructure or incentives, Tesla owners may face lower demand and reduced resale prices.

Tesla's Technological Advancements

One of the key drivers of Tesla's success is its commitment to technological innovation. Features such as over-the-air (OTA) updates, advanced driver-assistance systems (ADAS), and energy-efficient batteries have set Tesla apart from its competitors. However, these advancements also contribute to the "resale shocker" experienced by Tesla owners.

As newer models with enhanced features and improved battery technology enter the market, older models face increased competition. This rapid pace of innovation can lead to faster depreciation for older Tesla models, especially if they lack the latest technological upgrades. Tesla owners must carefully consider the impact of these advancements on their vehicle's resale value.

Impact of Economic Conditions

Economic conditions, including interest rates, inflation, and consumer confidence, also influence Tesla resale values. During periods of economic uncertainty, consumers may prioritize affordability over luxury, leading to reduced demand for higher-priced Tesla models. Additionally, fluctuations in the cost of raw materials, such as lithium and cobalt, can impact production costs and, consequently, resale values.

Recent global economic challenges, including supply chain disruptions and rising interest rates, have created a challenging environment for the automotive industry as a whole. Tesla owners must remain vigilant about these macroeconomic factors and their potential impact on resale prices.

Consumer Preferences and Brand Loyalty

How Consumer Preferences Affect Tesla Resale

Consumer preferences play a significant role in shaping Tesla resale trends. As more automakers enter the EV market, Tesla faces increased competition from brands offering similar features and price points. This competition has led to a shift in consumer preferences, with some buyers opting for alternative EV models.

Despite this competition, Tesla's brand loyalty remains strong. Many Tesla owners are repeat customers, driven by the brand's reputation for quality, innovation, and sustainability. This loyalty can help stabilize resale values, especially for popular models such as the Model 3 and Model Y.

Industry Trends and Future Outlook

The EV industry is evolving rapidly, with new entrants and technological advancements reshaping the market landscape. As Tesla continues to innovate and expand its product lineup, the resale market is likely to experience further changes. Industry experts predict that the introduction of new models, such as the Cybertruck and Roadster, could have a significant impact on resale values for existing Tesla vehicles.

Additionally, the growing demand for sustainable transportation solutions is expected to drive increased adoption of EVs, benefiting Tesla's resale market. However, Tesla owners must remain aware of emerging trends and their potential impact on resale values.

Strategies for Maximizing Tesla Resale Value

Tips for Tesla Owners to Protect Their Investment

To maximize Tesla resale value, owners can adopt several strategies:

- Maintain the vehicle in excellent condition, both mechanically and aesthetically

- Minimize mileage to preserve the battery's health and overall value

- Regularly update the vehicle's software to ensure access to the latest features

- Consider selling in regions with high EV adoption rates for better demand

- Research market trends and timing your sale strategically

By implementing these strategies, Tesla owners can protect their investment and achieve better resale outcomes.

Common Misconceptions About Tesla Resale

There are several misconceptions surrounding Tesla resale values that can mislead owners. One common misconception is that Tesla vehicles retain their value indefinitely due to the brand's reputation. While Tesla vehicles generally hold their value well, they are not immune to depreciation, especially as newer models with advanced features enter the market.

Another misconception is that Tesla's over-the-air updates eliminate the need for physical upgrades, ensuring long-term value. While software updates enhance the vehicle's functionality, they do not compensate for hardware obsolescence or aesthetic wear and tear.

Conclusion

Tesla resale values are influenced by a complex interplay of factors, including market demand, technological advancements, economic conditions, and consumer preferences. Understanding these dynamics is essential for Tesla owners looking to navigate the resale market successfully. By staying informed about industry trends and adopting strategies to protect their investment, Tesla owners can mitigate the "resale shocker" and achieve better outcomes.

We invite you to share your thoughts and experiences in the comments section below. Have you encountered any surprises while selling your Tesla? What strategies have you found effective in maximizing resale value? Additionally, explore our other articles for more insights into the EV market and Tesla's impact on the automotive industry.

Table of Contents

- Understanding Tesla Resale Value

- Depreciation Rates of Tesla Vehicles

- Market Demand and Supply Dynamics

- Tesla's Technological Advancements

- Impact of Economic Conditions

- Consumer Preferences and Brand Loyalty

- Industry Trends and Future Outlook

- Strategies for Maximizing Tesla Resale Value

- Common Misconceptions About Tesla Resale

- Conclusion

- Ny Banker Charged With Rape A Comprehensive Analysis

- Dodgers Outfielder May Miss Roster A Comprehensive Analysis

- Why Was Us Airman Shot Unveiling The Truth Behind The Incident

- Wendy Williams Hospitalized Amid Guardianship Plea A Comprehensive Insight

- Rubio Ukraine Needs Talks Not War Ndash A Comprehensive Analysis

ETC. Positive Living The viral claim about a “Tesla Pi phone” with

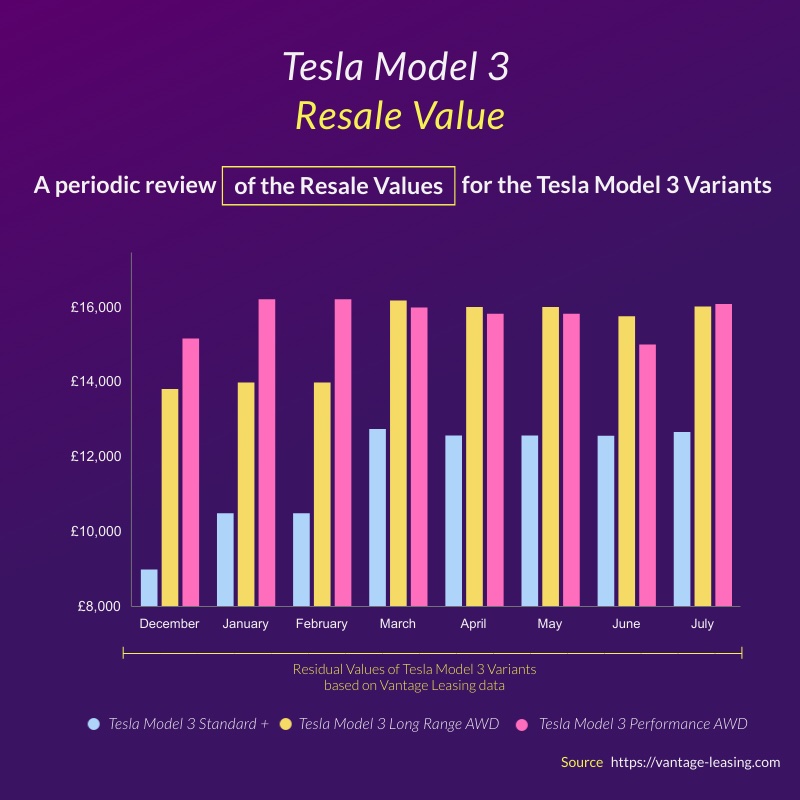

TeslaResaleValuesVantageLeasing TESLARATI

Tesla Resale Value Is It Worth The Investment?