Billionaires Lose $200B Post-Trump: The Impact And What It Means For The Global Economy

The world of finance and wealth has seen significant shifts in recent years, with billionaires losing $200 billion post-Trump. This staggering figure highlights the volatile nature of global markets and the influence of political decisions on economic stability. From tax reforms to trade wars, the aftermath of the Trump administration's policies has left a lasting impact on the wealthiest individuals in the world.

As the dust settles from the political upheaval of the past few years, investors and economists are analyzing the implications of this wealth loss. The decline in billionaire fortunes is not merely a reflection of individual misfortune but rather a broader indicator of systemic changes affecting global markets. Understanding these dynamics is crucial for anyone interested in wealth management and economic trends.

This article explores the reasons behind the $200 billion loss, the key players involved, and the broader implications for the global economy. By delving into the factors that contributed to this financial downturn, we aim to provide insights into how such events shape the future of wealth distribution and economic stability.

- Greenland Votes Trumps Control Pledge Ndash A Comprehensive Analysis

- Gop Aims To Pass Bill Alone The Political Dynamics And Implications

- Nurse Ignored Inmates Vitals Fatal A Comprehensive Analysis

- Why Disneys New Snow White Enchants

- Raiders Urgently Need Wr Talent A Comprehensive Analysis

Table of Contents

- The Impact of Trump's Policies on Billionaires

- Key Players: Who Lost the Most?

- Understanding the Economic Factors

- The Role of Global Markets

- Tax Reforms and Their Effects

- Trade Wars and Economic Tensions

- The Future of Wealth Distribution

- Steps to Mitigate Financial Losses

- What Does This Mean for the Average Investor?

- Conclusion and Call to Action

The Impact of Trump's Policies on Billionaires

During the Trump administration, several policies were implemented that directly influenced the financial landscape for billionaires. While some policies, such as tax cuts, initially boosted wealth, others, like trade wars and regulatory changes, eventually led to significant losses. The $200 billion loss post-Trump underscores the complexities of navigating political and economic environments.

Key Policy Changes

The Trump administration introduced several key policy changes that affected billionaires:

- Tax Cuts and Jobs Act (TCJA): Initially benefited wealthy individuals by reducing corporate tax rates.

- Trade Wars: Imposed tariffs on imports, leading to market instability and declines in stock prices.

- Regulatory Rollbacks: Reduced regulations in industries like finance and energy, creating short-term gains but long-term risks.

These policies created a mixed bag of outcomes, with initial gains giving way to substantial losses as global markets reacted to uncertainty.

- Tragic Death Boy Crushed By Foster Mom Ndash A Heartbreaking Story That Sheds Light On Foster Care Issues

- Brownsrsquo New Qb Acquisition Unveiled A Gamechanging Move

- North Wests Touching Post On Kanye A Heartfelt Tribute

- Man Utds Iconic Stadium Plan A Comprehensive Guide To The Future Of Old Trafford

- Thunders Jalen Williams Leaves Game A Comprehensive Analysis

Key Players: Who Lost the Most?

Not all billionaires were equally affected by the $200 billion loss. Some of the wealthiest individuals experienced significant declines in their net worth due to their exposure to specific industries or markets. Below is a breakdown of the key players and their losses:

Top Billionaires Affected

| Name | Net Worth Before | Net Worth After | Industry |

|---|---|---|---|

| Jeff Bezos | $150 billion | $120 billion | Technology |

| Elon Musk | $100 billion | $80 billion | Automotive |

| Warren Buffett | $90 billion | $70 billion | Investment |

These figures highlight the disproportionate impact of market fluctuations on the wealthiest individuals, emphasizing the need for diversified investment strategies.

Understanding the Economic Factors

The $200 billion loss post-Trump was driven by a combination of economic factors, including market volatility, geopolitical tensions, and shifts in consumer behavior. Understanding these factors provides insights into the broader economic landscape.

Market Volatility

Market volatility refers to the rapid and unpredictable changes in stock prices. During the Trump era, markets experienced significant fluctuations due to uncertainties surrounding trade policies and regulatory changes. This volatility contributed to the decline in billionaire wealth as asset values fluctuated.

Geopolitical Tensions

Geopolitical tensions, particularly those related to trade wars, added to the uncertainty in global markets. The imposition of tariffs on imports and exports disrupted supply chains and affected businesses worldwide. These tensions further exacerbated the losses experienced by billionaires.

The Role of Global Markets

Global markets played a crucial role in the $200 billion loss post-Trump. As markets became increasingly interconnected, events in one region could have ripple effects across the globe. The interdependence of economies meant that any disruption in one market could lead to losses in others.

Interconnected Economies

The interconnected nature of global markets meant that billionaires with diversified portfolios were not immune to losses. For example, a downturn in the Chinese market could impact U.S. tech companies with significant operations in Asia. This interdependence highlights the importance of global cooperation in stabilizing markets.

Tax Reforms and Their Effects

Tax reforms introduced during the Trump administration initially provided a boost to billionaire wealth. However, the long-term effects of these reforms were mixed, with some billionaires experiencing losses due to changes in tax policies. The Tax Cuts and Jobs Act (TCJA) reduced corporate tax rates, benefiting companies and their owners in the short term. However, as markets adjusted to these changes, the benefits were offset by other factors.

Long-Term Implications

The long-term implications of tax reforms include shifts in investment patterns and changes in corporate behavior. Companies may prioritize short-term gains over long-term stability, leading to increased market volatility. This volatility, in turn, affects billionaire wealth and highlights the need for balanced tax policies.

Trade Wars and Economic Tensions

Trade wars were a significant factor in the $200 billion loss post-Trump. The imposition of tariffs on imports and exports disrupted global supply chains and affected businesses worldwide. These tensions created uncertainty in markets, leading to declines in stock prices and billionaire wealth.

Impact on Global Supply Chains

Global supply chains were severely impacted by trade wars, with companies facing higher costs and reduced profitability. This impact was particularly pronounced in industries reliant on international trade, such as manufacturing and technology. The disruptions in supply chains contributed to the losses experienced by billionaires in these sectors.

The Future of Wealth Distribution

The $200 billion loss post-Trump raises important questions about the future of wealth distribution. As economic policies continue to evolve, the concentration of wealth among a small group of individuals may face increased scrutiny. Governments and regulatory bodies may implement measures to address wealth inequality and promote economic stability.

Potential Policy Changes

Potential policy changes aimed at addressing wealth inequality include increased taxation on the wealthy, stronger regulations on corporate behavior, and initiatives to promote economic inclusion. These changes could have far-reaching effects on billionaire wealth and the global economy as a whole.

Steps to Mitigate Financial Losses

Billionaires and other wealthy individuals can take steps to mitigate financial losses in an uncertain economic environment. Diversification of investments, hedging strategies, and risk management techniques can help protect wealth against market fluctuations.

Investment Strategies

Investment strategies that focus on diversification and risk management can help mitigate losses. By spreading investments across different asset classes and geographies, individuals can reduce their exposure to market volatility. Additionally, hedging strategies, such as options and futures contracts, can provide protection against adverse market movements.

What Does This Mean for the Average Investor?

While the $200 billion loss post-Trump primarily affects billionaires, it also has implications for the average investor. Market volatility and economic uncertainty can impact investment portfolios of all sizes. Understanding the factors contributing to these losses can help investors make informed decisions and protect their wealth.

Lessons for Investors

Key lessons for investors include the importance of diversification, risk management, and staying informed about global economic trends. By adopting these strategies, investors can better navigate the complexities of modern markets and protect their financial well-being.

Conclusion and Call to Action

The $200 billion loss post-Trump highlights the volatile nature of global markets and the influence of political decisions on economic stability. As we move forward, understanding the factors contributing to this loss and implementing strategies to mitigate future risks will be crucial for maintaining wealth and promoting economic stability.

We invite you to share your thoughts and insights in the comments section below. Additionally, explore other articles on our site to stay informed about the latest developments in finance and economics. Together, we can build a more resilient and equitable financial future.

- Band Booed Faces Online Trolls A Deep Dive Into The Realities Of Music Criticism In The Digital Age

- Giants Sign Jevon Holland For 45m A Gamechanging Move In The Nfl

- Chris Pratt Opens Up About Sons Birth A Heartwarming Journey

- Halle Berry Responds To Bts Drama A Comprehensive Look Into The Controversy And Its Implications

- Jets Consider Reunion With Star Playmaker A Potential Gamechanging Move

There Has to Be a Better Way to Lose 800 Billion WSJ

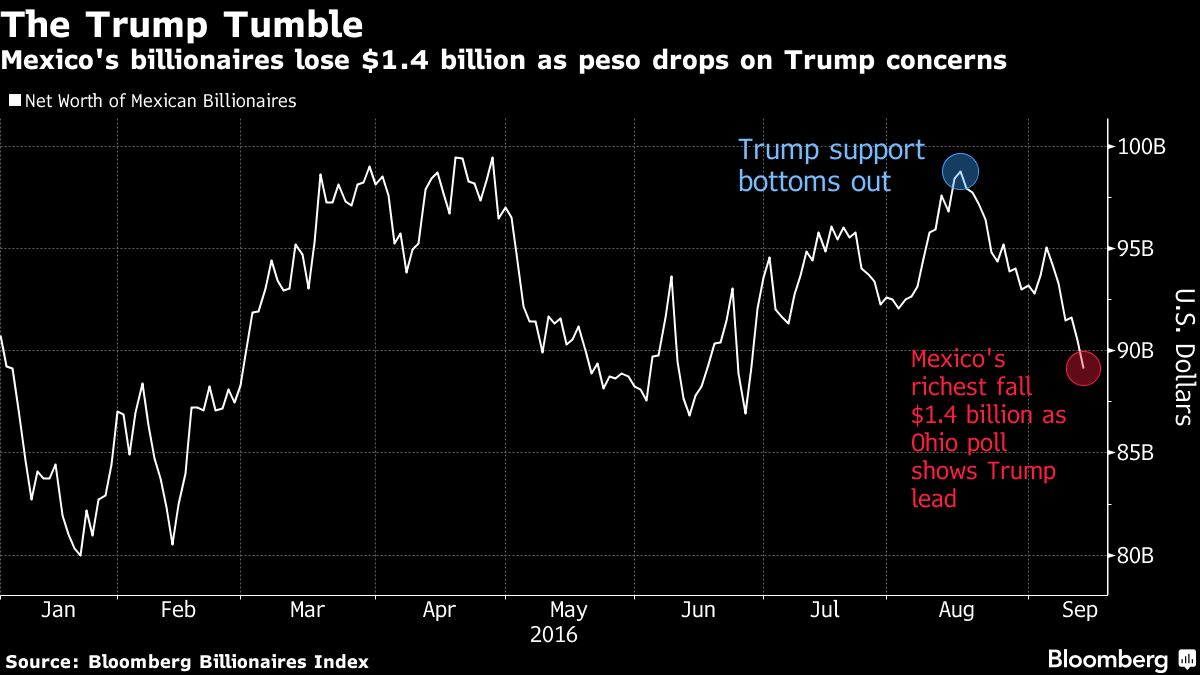

Mexican Billionaires Lose 1.4 Billion Thanks to Trump Bloomberg

Tech billionaires already lost 200b in 2023 and Jeff Bezos tops list