Tesla Stock: A Comprehensive Guide To Investing In The Future Of Electric Vehicles

Tesla stock has become one of the most talked-about investments in recent years. As the world shifts towards sustainable energy solutions, Tesla continues to lead the charge in the electric vehicle (EV) industry. Investors are increasingly looking at Tesla stock as a potential cornerstone of their portfolios.

With its innovative technology and ambitious goals, Tesla has captured the imagination of investors worldwide. However, before jumping into Tesla stock, it's crucial to understand the company's background, financial performance, market position, and potential risks.

This article will provide an in-depth analysis of Tesla stock, helping you make informed decisions about your investment strategy. Whether you're a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the complexities of Tesla's stock market.

- Trump Admin Shreds Usaid Evidence A Comprehensive Analysis

- Extn Cop Rehired Postscandal A Comprehensive Analysis

- Spencer Strider Criticizes Ronald Acuna A Deep Dive Into The Controversy

- Witness Inmates Target Vanished

- Earthquakes Threaten Us Volcano Eruption Understanding The Growing Risk

Table of Contents:

- Tesla's Company Overview

- Tesla Stock Performance

- Tesla's Market Position

- Tesla's Financials

- Risks Associated with Tesla Stock

- Insights from Tesla Investors

- Future Prospects for Tesla Stock

- How to Buy Tesla Stock

- Tesla Stock vs. Other EV Stocks

- Conclusion

Tesla's Company Overview

Tesla Inc. is a global leader in the design, manufacture, and sale of electric vehicles (EVs) and energy storage solutions. Founded in 2003 by a group of engineers, Tesla's mission is to accelerate the world's transition to sustainable energy. The company's founder, Elon Musk, has played a pivotal role in shaping Tesla's vision and strategy.

Tesla's Founding and Early Days

Tesla began its journey with the Roadster, a high-performance electric sports car that demonstrated the potential of EVs. Over the years, Tesla expanded its product lineup to include models like the Model S, Model 3, Model X, and Model Y. These vehicles have consistently received critical acclaim for their performance, range, and technological advancements.

- Exmaverick Returns To Lakers A Comprehensive Analysis

- Adele And Rich Pauls Relationship Crisis A Comprehensive Analysis

- Prince William Blasts Meghans Diana Comparisons An Indepth Analysis

- Ukraines Missile Downs Russian Jet Unraveling The Dynamics Of Modern Warfare

- North Wests Touching Post On Kanye A Heartfelt Tribute

Key Milestones in Tesla's History

- 2003: Tesla is founded in Palo Alto, California.

- 2008: The Tesla Roadster is introduced, marking the company's entry into the EV market.

- 2010: Tesla goes public, raising $226 million in its IPO.

- 2012: The Model S is launched, establishing Tesla as a leader in luxury EVs.

- 2017: Tesla begins production of the Model 3, targeting a broader audience.

Tesla Stock Performance

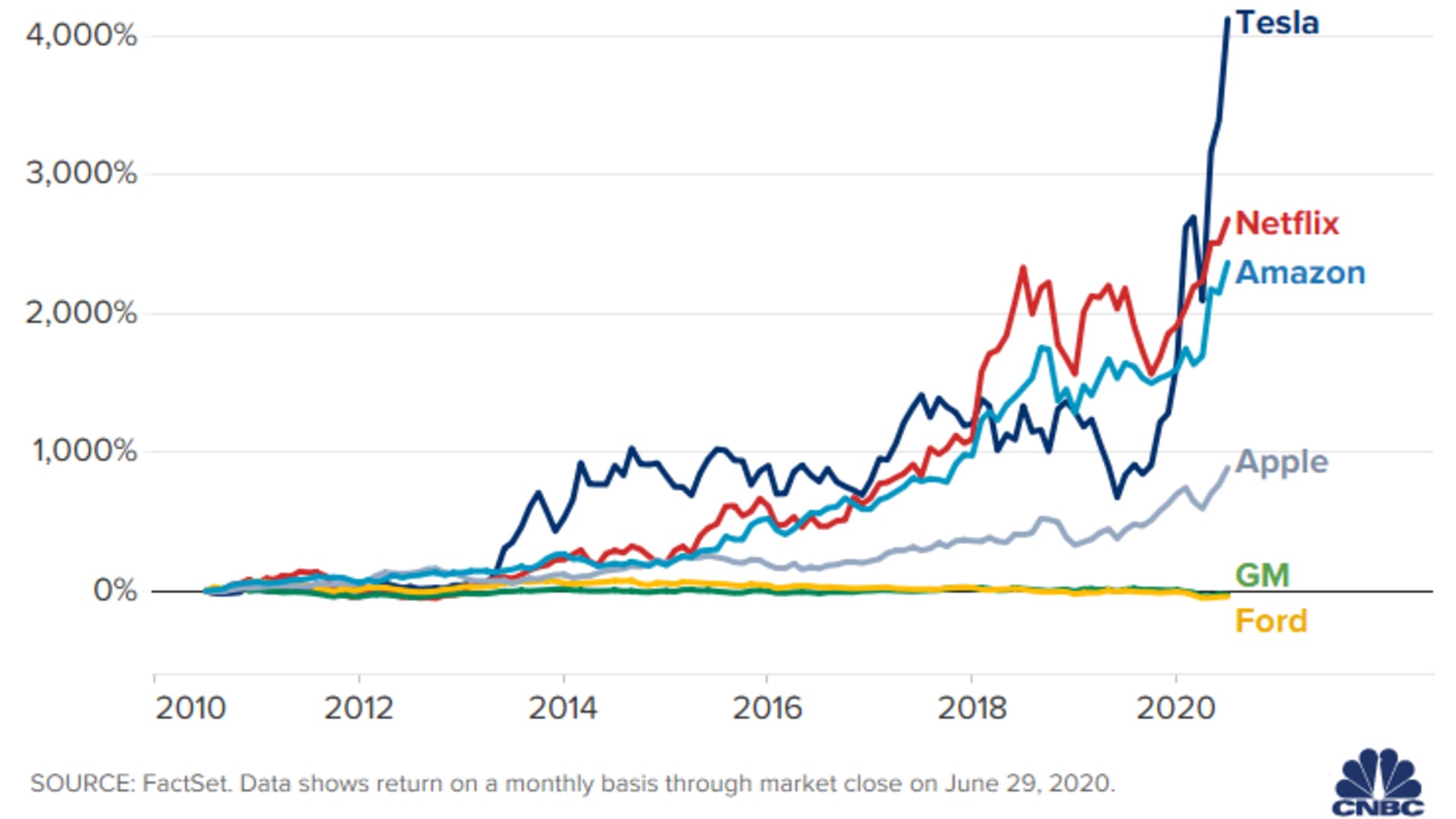

Tesla stock (ticker symbol: TSLA) has experienced remarkable growth since its IPO in 2010. Investors have been drawn to Tesla's innovative business model and its potential to dominate the EV market. However, the stock's performance has also been volatile, reflecting the challenges and uncertainties faced by the company.

Key Factors Driving Tesla Stock Growth

- Innovative product lineup: Tesla's vehicles are at the forefront of EV technology.

- Global expansion: Tesla has established manufacturing facilities in multiple countries, including the United States, China, and Germany.

- Sustainable energy solutions: Tesla's focus on renewable energy, including solar panels and energy storage systems, adds value to its portfolio.

Challenges Facing Tesla Stock

Despite its success, Tesla stock faces several challenges, including competition from other automakers, supply chain disruptions, and regulatory hurdles. These factors can impact the stock's performance and should be carefully considered by investors.

Tesla's Market Position

Tesla holds a dominant position in the EV market, with a market share of approximately 18% globally. The company's leadership in battery technology, autonomous driving, and software development sets it apart from its competitors. However, the EV market is becoming increasingly competitive, with traditional automakers and new entrants vying for market share.

Tesla's Competitive Advantage

- Brand recognition: Tesla is synonymous with innovation and quality in the EV space.

- Technology leadership: Tesla's advancements in battery technology and autonomous driving are unmatched.

- Global presence: Tesla's operations span multiple continents, giving it a significant advantage in terms of scale and reach.

Tesla's Financials

Tesla's financial performance has been impressive, with consistent revenue growth and increasing profitability. In 2022, Tesla reported revenue of $81.5 billion, up from $53.8 billion in 2021. The company's net income also increased, reaching $12.6 billion in 2022.

Key Financial Metrics

- Revenue Growth: Tesla's revenue has grown at a compound annual growth rate (CAGR) of over 50% over the past five years.

- Gross Margin: Tesla's gross margin has consistently improved, reflecting its economies of scale and operational efficiency.

- Cash Flow: Tesla generates strong cash flow, enabling it to invest in research and development and expand its operations.

Risks Associated with Tesla Stock

While Tesla stock offers significant potential for growth, it also comes with risks. Investors should be aware of these risks before making investment decisions.

Market Risks

The EV market is highly competitive, and Tesla faces increasing competition from established automakers and new entrants. This competition could impact Tesla's market share and profitability.

Regulatory Risks

Tesla operates in a heavily regulated industry, and changes in government policies could affect its business. For example, subsidies and incentives for EVs could be reduced or eliminated, impacting demand for Tesla's products.

Insights from Tesla Investors

Many investors view Tesla stock as a long-term investment opportunity. They are drawn to the company's innovative approach, strong leadership, and commitment to sustainability. However, some investors remain cautious, citing concerns about valuation and execution risks.

Why Investors Love Tesla

- Transformational Potential: Tesla is seen as a company that is reshaping the automotive industry.

- Strong Leadership: Elon Musk's vision and leadership inspire confidence among investors.

- Global Impact: Tesla's focus on sustainability aligns with global efforts to combat climate change.

Future Prospects for Tesla Stock

Tesla's future prospects are bright, with the company poised to benefit from the growing demand for EVs and renewable energy solutions. The company's plans to expand its product lineup, increase production capacity, and enter new markets further enhance its growth potential.

Upcoming Developments

- New Models: Tesla is working on new vehicle models, including the Cybertruck and the Semi.

- Battery Innovations: Tesla continues to invest in battery technology, aiming to reduce costs and improve performance.

- Energy Solutions: Tesla's energy storage and solar products are expected to play a larger role in its revenue mix.

How to Buy Tesla Stock

Investing in Tesla stock is straightforward. You can purchase shares through a brokerage account or a robo-advisor platform. It's important to conduct thorough research and consider your investment goals and risk tolerance before buying Tesla stock.

Steps to Buy Tesla Stock

- Open a brokerage account with a reputable provider.

- Deposit funds into your account.

- Search for Tesla stock using its ticker symbol (TSLA).

- Place an order to buy the desired number of shares.

Tesla Stock vs. Other EV Stocks

When evaluating Tesla stock, it's helpful to compare it with other EV stocks. Companies like Rivian, Lucid Motors, and NIO are also making waves in the EV market. However, Tesla's scale, technology, and brand recognition give it a distinct advantage.

Key Differences

- Market Share: Tesla holds a significant lead in terms of market share compared to its competitors.

- Financial Performance: Tesla's revenue and profitability surpass those of most other EV companies.

- Product Portfolio: Tesla offers a diverse range of products, including vehicles, energy storage, and solar solutions.

Conclusion

Tesla stock represents an exciting opportunity for investors looking to capitalize on the shift towards sustainable energy solutions. With its innovative technology, strong financial performance, and global presence, Tesla is well-positioned to lead the EV market for years to come.

However, investing in Tesla stock requires careful consideration of the risks and opportunities involved. By staying informed and conducting thorough research, you can make informed decisions about your investment strategy.

We invite you to share your thoughts and questions in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the world of investing and sustainable energy.

- Thomas Criticizes Scotus Case Handling A Comprehensive Analysis

- Walmart Compensates Customer Over Car Loss A Comprehensive Analysis

- Cowboys Sign Topranked Local Star A Gamechanging Move For The Franchise

- Eagles Plan After Losing Hero Strategic Moves To Rebuild And Thrive

- Jonbeneacutet Case Womans Shocking Claim

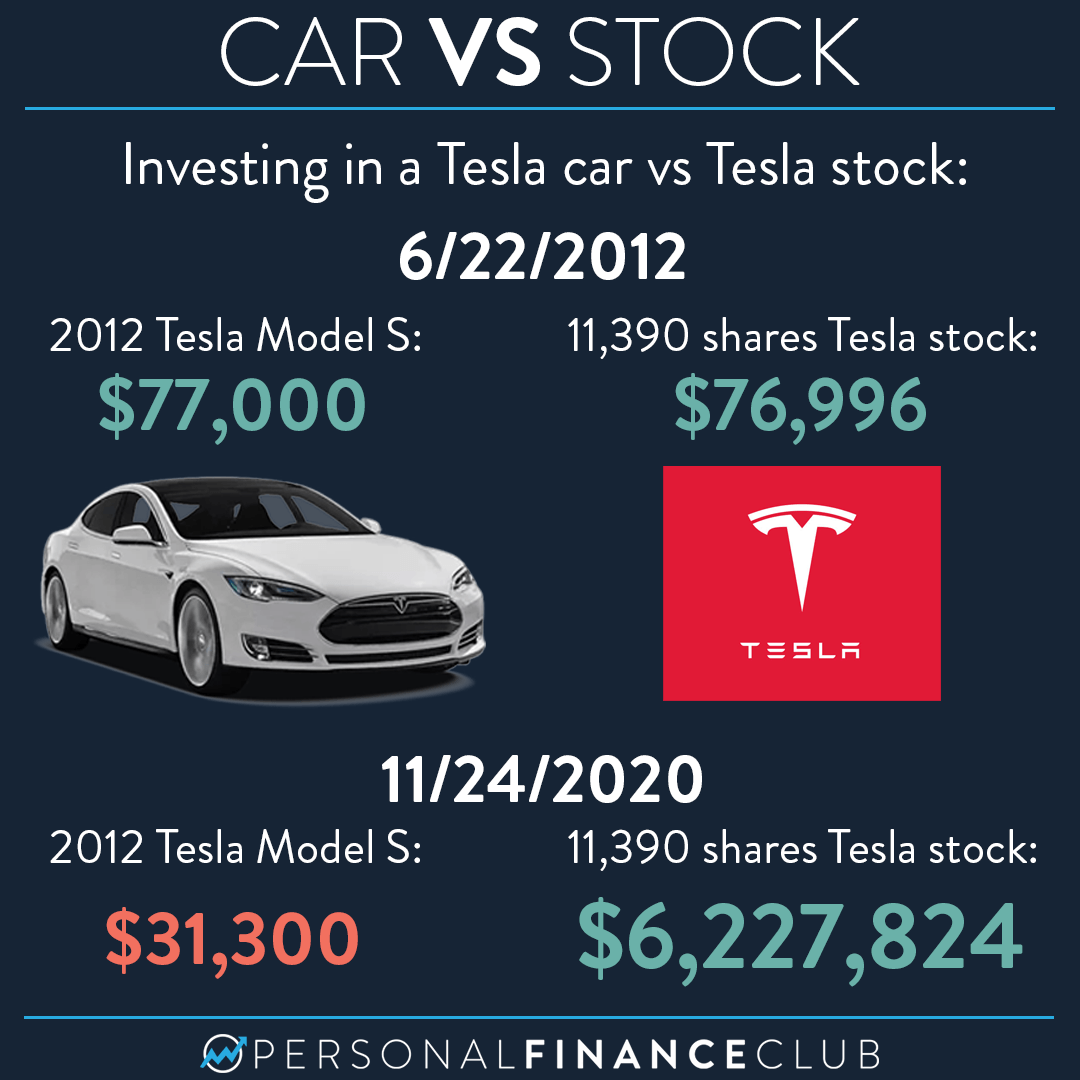

Returns from investing in a Tesla car vs Tesla stock Personal Finance

Tesla stock up 4125 since IPO ten years ago

Investors should sell Tesla stock if they don't like Musk's comments